sustainablevietnam.com September 5, 2023

By Christina Ameln, Sustainability Strategist and Advisor –

The EU’s Corporate Sustainability Reporting Directive (CSRD) is the most ambitious reporting directive putting climate, nature and social impacts (non-financial) equal to financial reporting. While it might seem as a regulation aimed exclusively at companies in the EU, the impact will be wide-reaching. Non-EU companies will also feel the impact, including in Vietnam. The potential significance of this regulation on Vietnamese companies, investments and especially Vietnam’s supply chain cannot be ignored.

For us to understand the impact, let’s review the:

- EU Green Deal;

- Corporate Sustainability Reporting Directive (CSRD);

- European Sustainability Reporting Standards (ESRS);

- Impact on Vietnam with a focus on company, investors and value chain with suppliers as the focus; and

- How this is not just about compliance but how organizations will put sustainability strategically front and center.

EU Ambitions: Green Deal

Let’s take a step back to understand where this all originates. In 2020, the European Commission launched its ambitious European Green Deal. The goal is to become the first climate-neutral continent by 2050. And among other sustainability related goals, the Green Deal aims to reduce Europe’s greenhouse gas emissions by 2030.

But the EU cannot do it alone.

Market participants, such as corporates to financial market players, play an important role in achieving and contributing to these targets in shifting away from an economy that encourages carbon-intensive business to one that drives transformation to a zero-carbon society. There is also the question of funding: According to the EU Commission, Europe will need an estimated EUR 350 billion in additional investment per year over this decade to meet its 2030 emissions-reduction target in energy systems alone, alongside the EUR 130 billion it will need for other environmental goals.

To understand the CSRD, we need to appreciate the financing of the Green Deal ambitions.

Related to the European Green Deal, the Sustainable Finance Action Plan (part of the wider EU Sustainable Finance Framework) was adopted in 2018. It is a direct response to the landmark signing of the Paris Agreement in 2015 and the United Nations 2030 Agenda for Sustainable Development 2015 which created the Sustainable Development Goals (SDGs).

The Plan contains tools, taxonomy (EU Taxonomy) and legislation to make sure monetary funds from Europe’s financial market players (e.g. investors and banks) are directed into and are aligned with EU’s definition of sustainable economic activities.

The financial market has its own set of regulations, i.e., the Sustainable Finance Disclosure Regulations (SFDR), which stipulates how to report and manage the impact of negative environmental and social risks of the investments. However, one of the struggles in directing capital to sustainable investments has been the reliability and comparability of sustainability information of companies (e.g. both corporate sustainability and financial reports and transparency on their impacts). This information is essential for making well-informed decisions.

Investors want an aligned and relevant understanding of sustainability risks and opportunities to invest in sustainable companies.

For the Green Deal to work, a key component is stronger alignment on sustainability information across the corporate sector.

Corporate Sustainability Reporting Directive (CSRD)

In comes the Corporate Sustainability Reporting Directive (CSRD) – a part of the Green Deal regulatory push to move its sustainability ambitions rapidly forward in the business community. The idea is for the corporate sector to be an active part in the EU ambitions and to enable investors to be better informed on sustainable investments. It is also designed to incentivize private financing of the EU’s Green Deal.

Image by Ecochain: 6 things businesses need to know about the CSRD

ESG Reporting

The CSRD requires companies to report annually on all three pillars of environmental, social and governance (ESG) activities and performance. It aims to improve the transparency and accountability of corporate sustainability, which has not previously been consistent. It requires CSRD to be reported in the management report and not as a separate document; this will mean greater connections with financial information. This will lift sustainability reporting to the same level as financial reporting, further pushing alignment of sustainability with day-to-day business activities.

Replace NFRD

CSRD will replace the Non-Financial Reporting Directive (NFRD), which obligated large companies to report on non-financial information but did not live up to the ambition of providing consistent data, comparability and compliance on reporting.

Larger Scope

The new directive applies to a larger scope of companies and will reach up to 50,000 companies across all sectors.

The scope of companies that must follow the new directive includes European companies and those listed on the EU-regulated markets need to meet two out of the following three criteria:

- €40 million in net turnover;

- €20 million on the balance sheet;

- 250 or more employees.

Non-European companies that generate an annual net turnover of EUR 150 million in the EU and that have at least one subsidiary or branch in the EU will also require sustainability reporting.

This directive also includes listed SMEs. It does not include microenterprises, i.e. companies with less than 10 employees or below EUR 20 million in turnover.

Double Materiality

Materiality allows the companies to focus their information on what’s material for their business. CSRD’s shift to double materiality looks inside-out to identify impacts the company has on people and the planet. Andoutside-in to evaluate the ESG-related risks and opportunities that can affect future cash flows and the company’s ability to generate other value in the short, medium or long term.

Assurance

In addition, it will demand mandatory limited assurance by a third-party bringing sustainability reporting up to the same importance, quality and control as in financial reporting within three years of adopting the CSRD.

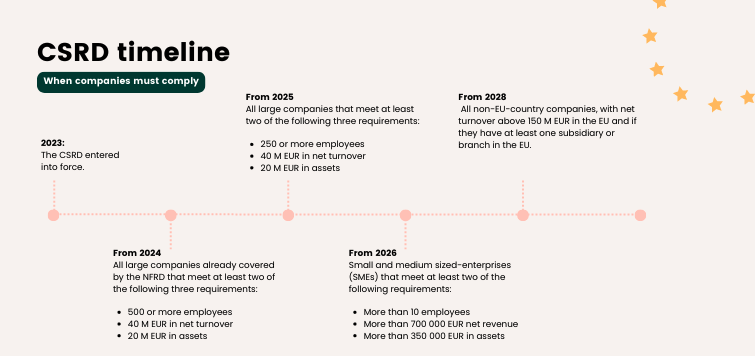

Image by Worldfavor: CSRD Timeline

European Sustainability Reporting Standards (ESRS)

While there is a staggered timeline to the mandatory reporting, preparation should start now.

The first set of companies, already subject to NRFD, will start collecting data 2024 that aligns with the CSRD. The data collection is supported by the recently issued framework, i.e., the European Sustainability Reporting Standards (ESRS). Thus, the CSRD is the regulation and the ESRS is the framework that guides the collection of information within that framework.

The framework is based on technical advice from the European Financial Reporting Group (EFRAG) – a private association with a mission to serve the public interest in both financial and sustainability reporting by developing and promoting European standards in corporate reporting. Two other important initiatives, Global Reporting Initiative (GRI) and the International Sustainability Standards Board (ISSB), have also worked closely with EFRAG to develop the reporting framework.

The ESRS outline requirements include four broad ESG categories:

- Cross-cutting: General principles, strategy, governance and materiality assessments

- Environment: Climate change, pollution, water and marine resources, biodiversity, resource use and circular economy

- Social: company workforce, workers in the value chain, affected communities, consumers and end-users

- Governance: governance, risk management, internal control and business conduct

Specific standards for ten sectors considered high impact and energy-intensive will soon follow.

Impact on Vietnam

We should not assume that these measures will not have an impact here in Vietnam. According to financial data firm Refinitiv, the directive impacts around 10,000 companies outside of the EU. Even if Vietnam companies are not in the top percentages of companies impacted in the Refinitiv research, many see this directive falling under the ‘Brussels Effect’ in which EU market regulation has a considerable and often global impact.

What does stand out is that the directive will have wide-reaching impact and influence as it requires extensive data collection and disclosures from all size companies and will also demand more data across the value chain and from EU company’s supply chain partners.

Let’s look at three angles from the Vietnam context – the company, the investor and the value chain with a focus on supply chains:

Company:

It is important to highlight again that whatever the size of your company and whether you are listed or not in the EU, expect sustainability questions to come your way. For example:

Large companies: If a Vietnamese company has a subsidiary on an EU market, listed on an EU stock exchange and is already reporting under the NFRD, it will have to start collecting the data in 2024 (to report in 2025), either at an individual level or later at a collective level with the parent company in Vietnam.

Even if not currently under the NFRD scope, any non-EU company with an annual revenue of €150 million and an EU branch with a net revenue of €40 million will have to report by 2028.

SMEs: Reporting requirements will eventually apply to any SMEs with EU listings. Although the requirement to report is not around the corner, SMEs should increasingly expect to receive requests for sustainability information from stakeholders who have to comply with CSRD sooner than SMEs.

Subsidiaries in Vietnam with EU parent company: Companies operating in Vietnam with a large parent company in the EU should expect to have to report data on their sustainability impacts. The increased expectation on reporting in turn impacts business partners and suppliers they work with in-country even if they do not fall under the CSRD scope.

Investor:

The CSRD will similarly impact on how investments take place. The CSRD should give the financial capital players the transparent sustainability information they want and move the needle in embracing more sustainable investments.

Full investor gamut: For example, the directive is likely to evolve the ESG investor practice to one in which CSRD data requirements will become part of the full gamut of investor processes, from due diligence, to the monitoring and remedial processes of its portfolio of companies, to its own investor reporting obligations under the EU’s Sustainable Finance Disclosure Regulation (SFDR).

More robust ESG lens: As Vietnam continues to be an attractive investment destination, the CSRD will impact the lens investors will use when looking at investing in Vietnamese companies. Many investors already have an ESG investment lens, yet the CSRD will demand a more robust process, better data, clarity, and assurance. It will be harder for investors to hide behind ‘lukewarm’ ESG practices or define their own brand of sustainable investments. In tightening its process to align with CSRD, investors will look to channel investment towards companies that are more sustainable and meet the CSRD requirements even in markets such as Vietnam.

EU Investments: For companies wanting and keeping foreign investments from the EU, understanding, preparing and adhering to the CSRD will be important.

Supply Chain:

Most companies’ climate impacts lie in their supply chain as and according to Ecochain, 80% of a company’s environmental footprint can come from it. This is an area that continues to receive scrutiny especially Vietnam’s manufacturing sector. This is due to companies looking to diversify its supply chain; new trade agreements being signed such as the EU-Vietnam Free Trade Agreement; and Vietnam’s own internal green strategy. So, for many manufacturers in Vietnam, sustainability questions are not new.

Greater value chain responsibility: Yet, one of the main points with the CSRD is that it places the company’s whole value chain at the center by extending reporting beyond the company’s footprint to e.g. suppliers. In other words, companies will have a greater responsibility for its supply chain.

Spotlight on transparency and due diligence: CSRD will put a stronger spotlight on supply chain transparency and due diligence with the addition of the Corporate Sustainability Due Diligence Directive (CSDDD) in 2023 and will require companies to address ESG challenges from own operations to its supply chain (from Scope 1, 2 and 3).

Sector specific standards: It is important to note that, under the ESRS Framework, more specific sector standards will be developed, including: oil and gas; coal, quarries and mining; road transport; agriculture, farming and fisheries; motor vehicles, energy production and utilities, good and beverages; and textiles, accessories, footwear and jewelry. Again, these sector specific standards are yet to be launched however, Vietnamese companies that engage in these sectors, can expect the sustainability questions in the near future.

Preferred suppliers: Parallel to what is coming out of the EU, we should also underscore that Vietnam itself has ambitious goals to meet Net Zero with commitment to cutting emissions by 2050. As an example, let’s look at PwC’s, The Circular Economy Transition, where it mentions how in the circular economy transition, Vietnam is one of the countries in Asia Pacific with a national circular economy policies/strategies. One can assume that combined national efforts will result in businesses looking deeper in to their supply chain and preferring suppliers choosing to work with those implementing sustainability.

In short, CSRD’s focus on the entirety of the value chain will mean that Vietnam manufacturers as key global suppliers will be impacted whether they are under the CSRD scope or not.

More than Compliance

This goes beyond a compliance exercise and moves sustainability from ‘nice to have’ to ‘must have’. It is strategic.

For companies, the CSRD aims to promote better risk management of corporate environmental and social impacts, allowing corporates to better assess long-term projects and investments. This will facilitate more informed decisions around corporate resilience, with sustainability at its core.

And in turn, instead of seeing sustainability as a standalone, it will encourage corporates to integrate sustainability into its corporate strategy, work across its business and value chain with business partners and suppliers; and communicate them more effectively to stakeholders.

For other stakeholders, plus financial market players, including ESG data as a requirement will improve accessibility and quality of data. The CSRD will provide investors with a better understanding of corporate sustainability risks and opportunities. This will facilitate better decision making and reorient capital toward sustainable investments and away from sectors contributing to global warming.

This all contributes to EU’s objective of promoting a sustainable and responsible economies. It pushes companies to account for ESG impacts on their activities and adopt more sustainable practices at EU level and beyond.

Get started

There is no doubt that aligning with this new directive will take resources, capacity, staff training and process redesign. That said, the benefits are multiple. They include improving insights into company performance, attracting more capital, taking ESG more seriously, clarifying reporting, reducing unnecessary costs, and improving company image.

For Vietnam, this is an exciting time as CSRD meets in-country sustainability ambitions to meet Net-Zero. For companies, investments and/or supply chain, this will be pivotal.

Do understand, do plan and do respond to this new directive before the regulation catches up with you.

Let’s get started.