9-10-2025 – Nguyễn Đình Đức

Tiasang – Năm 2025 đánh dấu 30 năm Việt Nam tham dự ASEAN và năm năm tới, Việt Nam dự kiến sẽ trở thành chủ tịch tổ chức khu vực này. Việt Nam có thể làm gì để đưa sự gắn kết trong khu vực lên một nấc thang mới?

Conversations on Vietnam Development

9-10-2025 – Nguyễn Đình Đức

Tiasang – Năm 2025 đánh dấu 30 năm Việt Nam tham dự ASEAN và năm năm tới, Việt Nam dự kiến sẽ trở thành chủ tịch tổ chức khu vực này. Việt Nam có thể làm gì để đưa sự gắn kết trong khu vực lên một nấc thang mới?

UNCTAD.org 23 April 2025

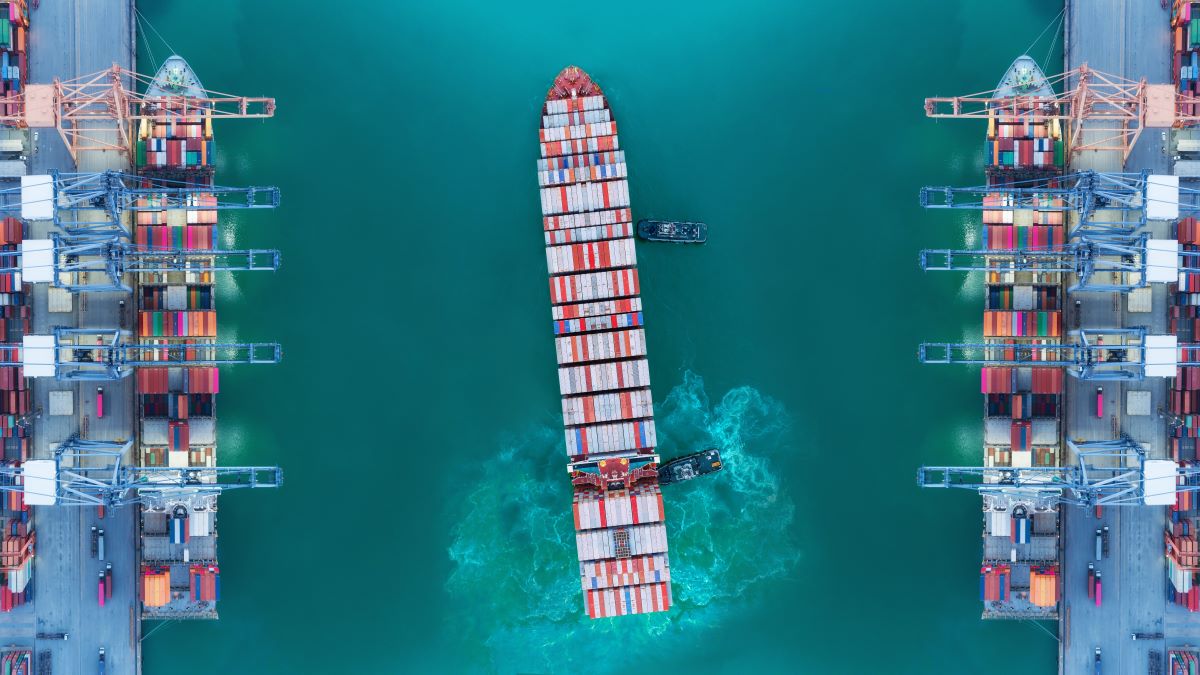

UN Trade and Development (UNCTAD) released on 15 April new seaborne trade data. For the first time, the dataset includes country-level statistics.

Maritime transport is the backbone of global trade, moving over 80% of goods traded worldwide by volume. It connects global value chains, carrying raw materials and semi-processed goods to production hubs and delivering finished products to consumers. These flows are vital for industrialization, economic growth and job creation.

Seaborne trade has evolved over the decades, shaped by containerization, the rise of developing economies and shifting production and consumption patterns. Today, digitalization, geopolitics and the push for sustainability and climate resilience are redefining the sector.

Reliable, up-to-date country-level data is key to understanding trade flows and guiding better transport and trade policies and investment decisions.

Built from official trade data reported by governments to UN Comtrade, the new dataset offers a more accurate and comparable view of global maritime cargo movements, helping countries to:

Historically, developing countries served mainly as loading hubs – major exporters of raw materials but marginal importers of manufactured goods. But this has evolved since the 1970s, driven by structural changes such as the oil crises, trade liberalization, increased private sector participation in port operations, the rise of container shipping and reforms to liner shipping alliances.

The shift accelerated in the early 2000s as developing countries increased trade among themselves – including in raw materials, oil and manufactured goods. Their share of global maritime freight rose from 38% in 2000 to 54% in 2023. The surge was led by Asia, with China driving much of the growth.

Read full article here https://unctad.org/news/shipping-data-unctad-releases-new-seaborne-trade-statistics

17 January 2025

Default image copyright and description© UNCTAD Photo | The Trade and Development Board meets for its 33rd special session in Geneva on 17 January.

The 16th session of the United Nations Conference on Trade and Development (UNCTAD16) will take place Viet Nam in October 2025 under the theme “Shaping the future: Driving economic transformation for equitable, inclusive and sustainable development”.

Tiếp tục đọc “UNCTAD16: Countries to meet in Viet Nam to propel development in a multipolar world”

by CEO, FOE & TNI

Effectively and fairly collecting taxes is essential for all states, and especially for developing countries that wish to sustainably develop. Tax collection also offers a means to guarantee quality public services for all and to collectively face the challenges of climate change. However, in Vietnam and in other countries, big corporations challenge governments that try to impose taxes on their massive profits. Investor-state dispute settlement (ISDS) is one of their main avenues to try to avoid paying taxes and to receive millions in compensation instead.

Tiếp tục đọc “ConocoPhillips & Perenco vs. Vietnam: Making profits but refusing to pay taxes”ANTG – Thứ Ba, 09/07/2024, 08:18

Mặc dù chưa ký hiệp định thương mại tự do (FTA) với ASEAN, nhưng EU vẫn duy trì sự hiện diện kinh tế mạnh mẽ trong khu vực. EU hiện là đối tác thương mại lớn thứ ba của ASEAN, chỉ sau Trung Quốc và Mỹ.

Thương mại ASEAN – EU năm 2022 đạt 295,2 tỷ USD – tăng 9,6% so với năm 2021. Ngoài ra, EU là nguồn FDI lớn thứ ba của ASEAN, với 24 tỷ USD năm 2022. Theo dữ liệu từ Báo cáo đầu tư ASEAN cùng kỳ, các quốc gia thành viên EU như Pháp, Đức và Hà Lan nằm trong số các nguồn FDI hàng đầu của ASEAN.

Vấn đề đặt ra lúc này là phải thúc cho đồng tiền chạy vào nền kinh tế, tạo ra giá trị mới.

Đầu tư công là động lực tăng trưởng quan trọng của nền kinh tế trong bối cảnh tư nhân gặp khó hiện nay, nhưng tám tháng qua giải ngân đầu tư công cả nước mới đạt khoảng 299.450 tỉ đồng, tương đương 42,35% kế hoạch cả năm.

Các chuyên gia dự báo nếu hoàn thành mục tiêu giải ngân 95% vốn đầu tư công trong năm nay thì GDP năm 2023 sẽ tăng thêm khoảng 1,3%.

Tại TP.HCM, trong số 68.786 tỉ đồng vốn đầu tư công năm 2023, tính đến ngày 17-8 mới giải ngân được 19.133 tỉ đồng, tương đương 27% kế hoạch vốn được giao. Trong báo cáo tình hình giải ngân năm 2023 vừa gửi tới Bộ Kế hoạch và Đầu tư, UBND TP cho biết giải ngân vốn ngân sách trung ương trong tám tháng đạt 11.200 tỉ đồng và từ ngân sách địa phương đạt khoảng 7.933 tỉ đồng.

Như vậy, tỉ lệ giải ngân của TP.HCM trong tám tháng thấp hơn khá nhiều so với tỉ lệ giải ngân 42,35% của cả nước.

Tiếp tục đọc “Đầu tư công: Thúc cho tiền ‘chạy’”sustainablevietnam.com September 5, 2023

By Christina Ameln, Sustainability Strategist and Advisor –

The EU’s Corporate Sustainability Reporting Directive (CSRD) is the most ambitious reporting directive putting climate, nature and social impacts (non-financial) equal to financial reporting. While it might seem as a regulation aimed exclusively at companies in the EU, the impact will be wide-reaching. Non-EU companies will also feel the impact, including in Vietnam. The potential significance of this regulation on Vietnamese companies, investments and especially Vietnam’s supply chain cannot be ignored.

For us to understand the impact, let’s review the:

Let’s take a step back to understand where this all originates. In 2020, the European Commission launched its ambitious European Green Deal. The goal is to become the first climate-neutral continent by 2050. And among other sustainability related goals, the Green Deal aims to reduce Europe’s greenhouse gas emissions by 2030.

But the EU cannot do it alone.

Market participants, such as corporates to financial market players, play an important role in achieving and contributing to these targets in shifting away from an economy that encourages carbon-intensive business to one that drives transformation to a zero-carbon society. There is also the question of funding: According to the EU Commission, Europe will need an estimated EUR 350 billion in additional investment per year over this decade to meet its 2030 emissions-reduction target in energy systems alone, alongside the EUR 130 billion it will need for other environmental goals.

Tiếp tục đọc “EU CORPORATE SUSTAINABILITY REPORTING DIRECTIVE (CSRD): THE WHY, HOW & IMPACT ON VIETNAM”

Ngày 24/2, Chương trình Phát triển LHQ (UNDP), Liên minh châu Âu, và Tổng cục Lâm nghiệp trực thuộc Bộ Nông nghiệp và Phát triển nông thôn phối hợp tổ chức hội thảo kỹ thuật về sản xuất và thương mại nông sản không gây mất rừng.

Hội thảo là cơ hội để đại biểu lắng nghe ý kiến đa dạng từ các diễn giả với hiểu biết và kinh nghiệm quý giá liên quan tới sản xuất và thương mại nông sản không gây mất rừng.

Theo ông Patrick Haverman, Phó Trưởng Đại diện Chương trình Phát triển Liên hợp quốc (UNDP) tại Việt Nam, việc phá rừng và suy thoái rừng đang là những nguyên nhân quan trọng gây ra biến đổi khí hậu và mất mát đa dạng sinh học trên toàn cầu.

Các hàng hóa dự kiến sẽ chịu tác động bởi Quy định này gồm: Dầu cọ, đậu nành, gỗ, gia súc, ca cao, cà phê, cao su và một số sản phẩm có nguồn gốc từ đó (ví dụ: sôcôla, đồ nội thất, lốp xe, sản phẩm in).

Tiếp tục đọc “Sản phẩm sản xuất trên đất chặt phá rừng sẽ không được phép vào thị trường châu Âu”Climate Change News | 4 August 2023

A Spanish solar plant in 2022 (REUTERS/Guillermo Martínez)

London’s High Court has ruled that two investors in Spanish solar energy plants are entitled to seize a Spanish property in London to enforce a judgment in a long-running dispute over renewable energy incentives.

The court’s interim charging order – meaning it is not yet final and can be objected to by the debtor – was issued on Wednesday but made public on Friday.

->

Stock image.

A recent study by Charles River Associates (CRA) outlines some worrying trends for global mining as the industry continues to expand and push into new markets.

The Toronto-based consultants, specialising in economic litigation found disputes between governments and investors involving mineral assets are growing rapidly – with 60% of all arbitrations over the last fifty years filed in the last decade.

Tiếp tục đọc “Mining is growing rapidly – so are investor-state disputes”UNCTAD.org 30 August 2023

© Shutterstock/Sander van der Werf | Wind turbines and a coal power plant in Eemshaven port in the Netherlands.

Sweltering heatwaves each year underline the need for a faster energy transition and speedier reform of international investment agreements (IIAs) to support the shift away from fossil fuels.

To reach net zero emissions by 2050, annual clean energy investment worldwide needs to more than triple to $4 trillion by 2030.

But many investment treaties, especially older ones, can hinder the transition. As countries try to cut ties with fossil fuels, oil and gas firms might use these treaties to challenge policy changes. An example is a coal phase-out claim against the Netherlands.

Tiếp tục đọc “Energy transition calls for faster investment treaty reforms”

gtreview.com ASIA / 18-04-23 / BY ELEANOR WRAGG

As the Regional Comprehensive Economic Partnership (RCEP) machine whirrs into life and trade flows within the bloc increase, could its paucity of explicit ESG provisions lead to a lowering of sustainability ambitions for trade? Eleanor Wragg reports.

Just over a year has passed since RCEP, the world’s largest trade agreement, came into force. Covering a third of the world’s population and linking together least developed countries (LDCs) such as Laos, Cambodia and Myanmar to wealthier nations like Australia, China, South Korea and Japan, the deal promises to inject new impetus into regional integration and cement the position of ‘Factory Asia’ at the centre of the world’s supply chains.

The well-documented linkages between trade liberalisation and increased productivity, wages and employment could help some of RCEP’s poorest countries inch closer to achieving United Nations Sustainable Development Goals (SDGs) 1 – no poverty, and 8 – decent work and economic growth.

However, unlike most recent preferential trade pacts, RCEP does not contain provisions on topics such as the environment or labour rights, raising questions about the extent to which it balances economic interest with social and environmental protections.

A shot in the arm for Asian trade

Thrashed out over eight long years of painstaking negotiations between the 10 Asean member states, Australia, China, Japan, New Zealand, South Korea as well as India – which walked away from talks before they were finalised – RCEP streamlines the tangled web of bilateral trade agreements among its signatories into a bumper megadeal that spans 510 pages of agreement text and thousands upon thousands of pages of associated schedules.

Boston University Global Development Policy Center

A controversial legal process known as investor-state dispute settlements (ISDS) is making it difficult for governments to mobilize finance for ambitious climate action.

When assets are protected by international investment treaties, like the Energy Charter Treaty, legal claims can be brought against countries by investors who feel they are negatively impacted by government policies. For example, Italy was recently ordered to pay UK-based oil/gas company Rockhopper more than €190 million for the Italian government’s refusal to grant an offshore oil concession. A May 2022 study in Science found potential ISDS claims globally could total as much as $340 billion.

Tiếp tục đọc “Investor-State Dispute Settlement: Obstructing a Just Energy Transition”

Published: July 6, 2022 6.28pm BST

Five young people whose resolve was hardened by floods and wildfires recently took their governments to the European Court of Human Rights (ECHR). Their claim concerns each country’s membership of an obscure treaty they argue makes climate action impossible by protecting fossil fuel investors.

The energy charter treaty has 52 signatory countries which are mostly EU states but include the UK and Japan. The claimants are suing 12 of them including France, Germany and the UK – all countries in which energy companies are using the treaty to sue governments over policies that interfere with fossil fuel extraction. For example, the German company RWE is suing the Netherlands for €1.4 billion (£1.2 billion) because it plans to phase out coal.

The claimants aim to force their countries to exit the treaty and are supported by the Global Legal Action Network, a campaign group with an ongoing case against 33 European countries they accuse of delaying action on climate change. The prospects for the current application going to a hearing at the ECHR look good. But how simple is it to prise countries from the influence of this treaty?