Reliefweb.int

Full report https://www.weforum.org/publications/global-risks-report-2025/

World Economic Forum, public.affairs@weforum.org

- State-based armed conflict emerges as the top immediate risk for 2025, identified by nearly a quarter of respondents, reflecting heightened geopolitical tensions and fragmentation globally.

- Misinformation and disinformation lead the short-term risks and may fuel instability and undermine trust in governance, complicating the urgent need for cooperation to address shared crises.

- Environmental risks dominate the 10-year horizon, led by extreme weather events, biodiversity loss and ecosystem collapse.

- Read the Global Risks Report 2025 here and join the conversation using #Risks25. Follow the Annual Meeting here and on social media using #WEF25

Geneva, Switzerland, 15 January 2025 – The 20th edition of the World Economic Forum’s Global Risks Report, released today, reveals an increasingly fractured global landscape, where escalating geopolitical, environmental, societal and technological challenges threaten stability and progress. While economic risks have less immediate prominence in this year’s survey results, they remain a concern, interconnected with societal and geopolitical tensions.

State-based armed conflict is identified as the most pressing immediate global risk for 2025, with nearly one-quarter of respondents ranking it as the most severe concern for the year ahead.

Misinformation and disinformation remain top short-term risks for the second consecutive year, underlining their persistent threat to societal cohesion and governance by eroding trust and exacerbating divisions within and between nations. Other leading short-term risks include extreme weather events, societal polarization, cyber-espionage and warfare.

Environmental risks dominate the longer-term outlook, with extreme weather events, biodiversity loss and ecosystem collapse, critical change to Earth systems and natural resources shortages leading the 10-year risk rankings. The fifth environmental risk in the top 10 is pollution, which is also perceived as a leading risk in the short term. Its sixth-place ranking in the short term reflects a growing recognition of the serious health and ecosystem impacts of a wide range of pollutants across air, water and land. Overall, extreme weather events were identified prominently as immediate, short-term and long-term risks.

The long-term landscape is also clouded by technological risks related to misinformation, disinformation and adverse outcomes of AI technologies.

“Rising geopolitical tensions and a fracturing of trust are driving the global risk landscape” said Mirek Dušek, Managing Director, World Economic Forum. “In this complex and dynamic context, leaders have a choice: to find ways to foster collaboration and resilience, or face compounding vulnerabilities.”

Fractured systems, fragile futures

The report, which draws on the views of over 900 global risks experts, policy-makers and industry leaders surveyed in September and October 2024, paints a stark picture of the decade ahead. Respondents are far less optimistic about the outlook for the world over the longer term than the short term. Nearly two-thirds of respondents anticipate a turbulent or stormy global landscape by 2035, driven in particular by intensifying environmental, technological and societal challenges.

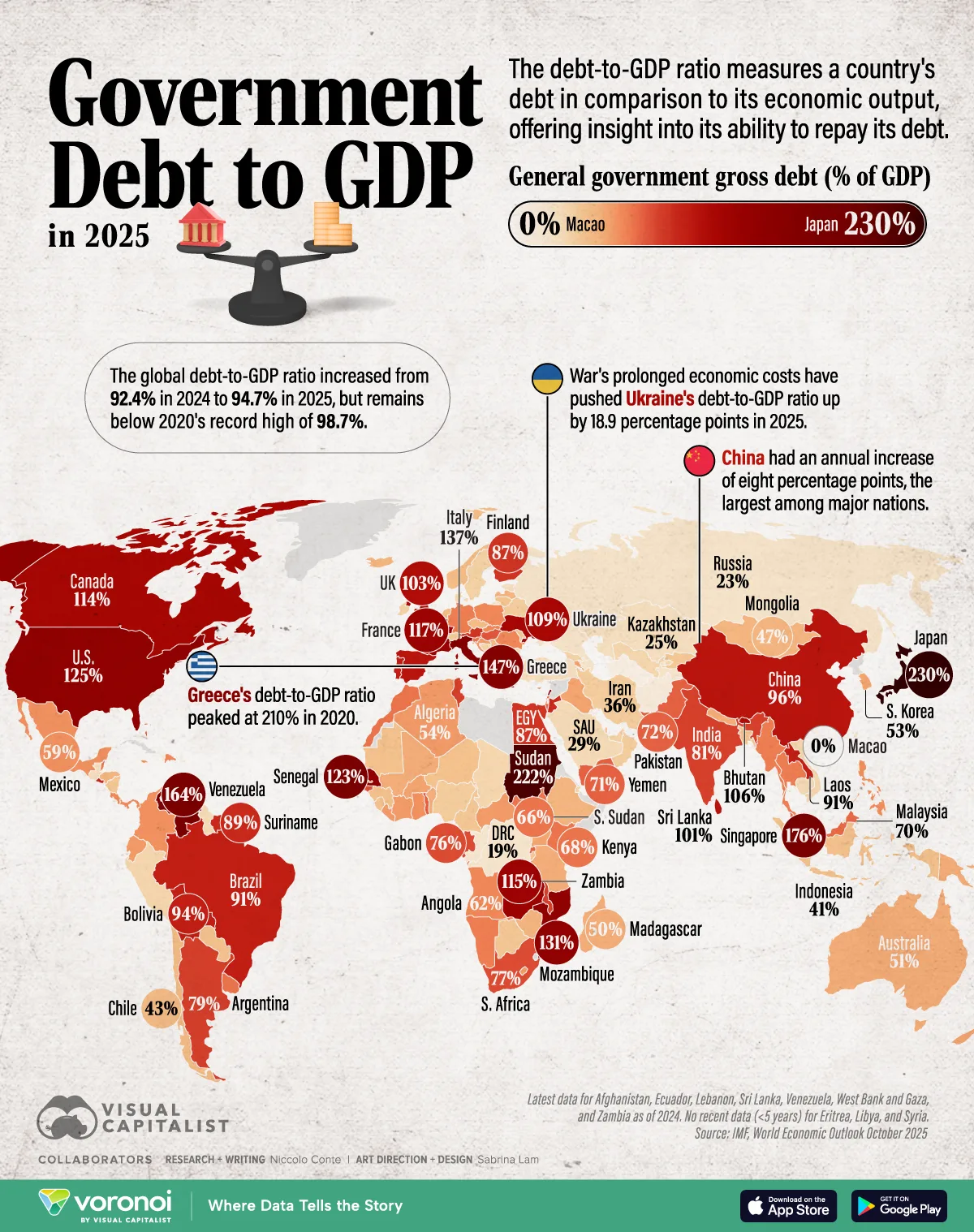

Over half of respondents expect some instability within two years, reflecting the widespread fracturing of international cooperation. Long-term projections signal even greater challenges as mechanisms for collaboration are expected to face mounting pressure. Societal risks such as inequality and societal polarization feature prominently in both short- and long-term risk rankings. Rising concerns about illicit economic activity, mounting debt burdens and the concentration of strategic resources highlight vulnerabilities that could destabilize the global economy in the coming years. All these issues risk exacerbating domestic instability and eroding trust in governance, further complicating efforts to address global challenges.

All 33 risks in the ranking increase in severity score over the longer term, reflecting respondents’ concerns about the heightened frequency or intensity of these risks as the next decade unfolds.

“From conflicts to climate change, we are facing interconnected crises that demand coordinated, collective action,” says Mark Elsner, Head of the Global Risks Initiative, World Economic Forum. “Renewed efforts to rebuild trust and foster cooperation are urgently needed. The consequences of inaction could be felt for generations to come.”

A decisive decade: Collaboration as the key to stability

As divisions deepen and fragmentation reshapes geopolitical and economic landscapes, the need for effective global cooperation has never been more urgent. Yet, with 64% of experts anticipating a fragmented global order marked by competition among middle and great powers, multilateralism faces significant strain.

However, turning inward is not a viable solution. The decade ahead presents a pivotal moment for leaders to navigate complex, interconnected risks and address the limitations of existing governance structures. To prevent a downward spiral of instability – and instead rebuild trust, enhance resilience, and secure a sustainable and inclusive future for all – nations should prioritize dialogue, strengthen international ties and foster conditions for renewed collaboration.

Links to other visuals and graphics

– Current Risk Landscape – 2025

– Global risks ranked by severity- 2 years

– Global Risks ranked by severity – 10 years

– Short and long-term global outlook

– Global risks landscape an interconnections map

About the Global Risks Report

The Global Risks Report is the World Economic Forum’s flagship publication on global risks, now in its 20th edition. Produced by the Global Risks Initiative at the Forum’s Centre for the New Economy and Society, the report leverages insights from the Global Risks Perception Survey, which draws on the views of over 900 global leaders across business, government, academia and civil society. The report identifies and analyses the most pressing risks across immediate, short- and long-term horizons, aiming to equip leaders with foresight to address emerging challenges. It serves as a key resource for understanding the evolving global risk landscape and fostering collective action to build a more resilient future.

For more information, visit the Global Risks Initiative and read the full report here.